Jan 25, 2018 – After having spent a week playing around with the Metatrader4 demo platform from HotForex, I was beginning to feel comfortable with the idea of placing some trades using live prices in the demo account. First off, I need to establish some ground rules in order to try to preserve the USD 5,000 paper trading account.

I want to try to make the demo trading feel as real as possible. I understand that demo trading can never really match the feeling of risking, and inevitably losing, your own hard-earned money in a real trading account. However, if I can’t prove to be consistently successful in demo mode, I will need to reevaluate my aspirations to becoming a full time forex trader.

The truth is that having to work a normal hours job during the week also slightly inhibits my trading focus as I’m only able to monitor the markets for opportunities during European time evening trading sessions. Nevertheless, I have formed some basic rules which will (hopefully!) restrict any impulsive or panic trades.

The first rule is I don’t need to trade every day. I will only take trades when I see them and when I am feeling that it is a setup I like. My other rules are that I will only trade on the 1 hour or faster charts initially, never have a risk-reward higher that 1:1 and always use a stop loss.

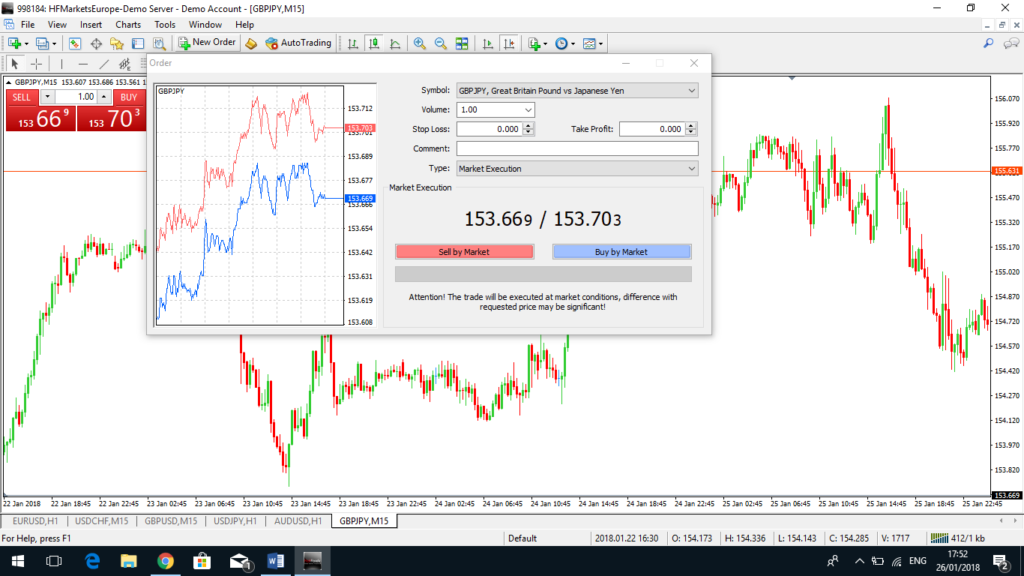

With this in mind, I took one evening this week to look for potential setups to place my first trade. As I am still trying to get to grips with the HotForex MT4 platform, I was favoring trades which would allow me to place an order (stop or limit order) which would then be triggered in the future, rather than trying to execute an immediate trade. This would give me more time to think out and carefully place the trades, stops and take profit levels in line with the basic rules that I was looking to adhere to. The screenshot below shows the MT4 screen when placing an order in the market using the “New Order” button on the top toolbar.

Some of my preferred indicators are support and resistance levels. This is what seem to gravitate towards and perhaps understand better at this time. I have been working on studying charts to try to anticipate where price will interact with previous levels of support and resistance. For my first trades this plan seemed perfect as my idea was to place an order in the market where I was thinking that price would react and set a small take profit and stop loss. Once I had developed my skills at placing orders and watching the live trades open and close, I could then begin to look for more technical setups which would allow me to do some immediate-execution trades.

After scouring the EURUSD, GBPJPY and GBPUSD charts on the hourly time frame, I decided that there could be a few viable trades. In reality, I saw twenty or thirty setups on each chart which were probably less “setups” and more the adrenaline I felt looking to place my first trade.

Realising that I was in danger of wanting to place hundreds of trades, and break every rule I had made, I looked again at my criteria and decided to narrow my search down to a handful of possibilities. The critical factor was that the order would have to have a good chance of being triggered during that evening (who wants to wait until tomorrow?). I singled out one opportunity that I decided to be my first trade.

EURUSD Trade

The chart below shows my first EURUSD trade. My reasoning at the time was that price had recently broken out of a triangle and momentum over the past 24 hours was with the bulls. A number of 1-2-3 setups, where price pulls back a bit then rockets higher had formed and price had reached a new recent high. I decided to use the recent resistance level, which had been broken strongly to form a new area of support. In hindsight both my take profit and stop were way too short for an hourly trade, and I was also about an hour late placing the trade as price had already moved down to this area and the start of a new green candle showed price moving away from my order zone (the green line on the chart below). I felt sure, however, that if price came back down, I wanted to go long again from that point and I placed an order for 1 lot.

The outcome was positive and my first trade proved to be a success with the order triggering two hours later and the take profit level very easily reached. It was not, however, all smooth sailing and I woke up the next day to review just how close price had come to my stop loss (see chart below). I had set a 1:1 risk to reward ratio on this and opted to try to achieve just 10 pips. Looking back this probably should have been much larger, although I was very pleased to start with a positive trade which quickly proved to be beginners luck…

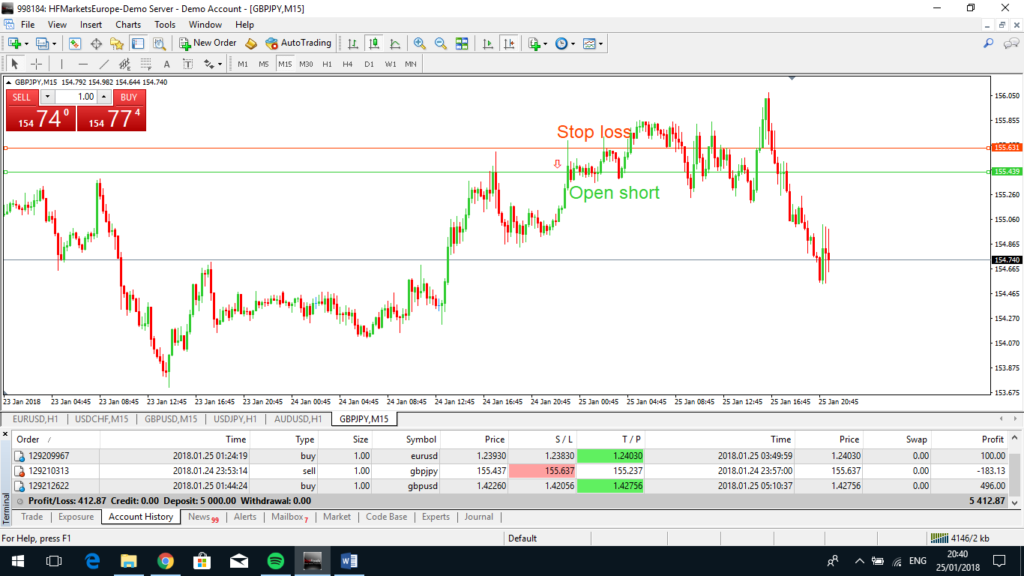

GBPJPY Trade

Looking back, I know that I should not have tried to take this trade, not least because the GBPJPY is one of my least favorite support and resistance pairs. I very rarely seem to spot good scalping trades and have not studied it nearly as well as the EURUSD and GBP. I am therefore putting this trade in my book of bad trades. As seen on the chart, my idea was to take a “bounce trade” of the close of a recent high a price approached this again. I was sure that it would give some resistance and you can imagine how my heart sank when the order triggered and price continued to spike over to hit my stop loss.

Given the volatility of the GBPJPY, even on 15minute charts, I had placed a 1:1 trade almost 20 pips either side of the order level. This immediately wiped out my previous gain and put my account in to the red. At this point I tried to reassure myself that losses were normal but there was no way I could avoid feeling annoyed at myself for taking such a risky gamble. The evidence of this disaster trade is below.

Desperate to make up for my previous error and in trying to re-focus on logical, reasoned trades, I thought I would try one more trade this week.

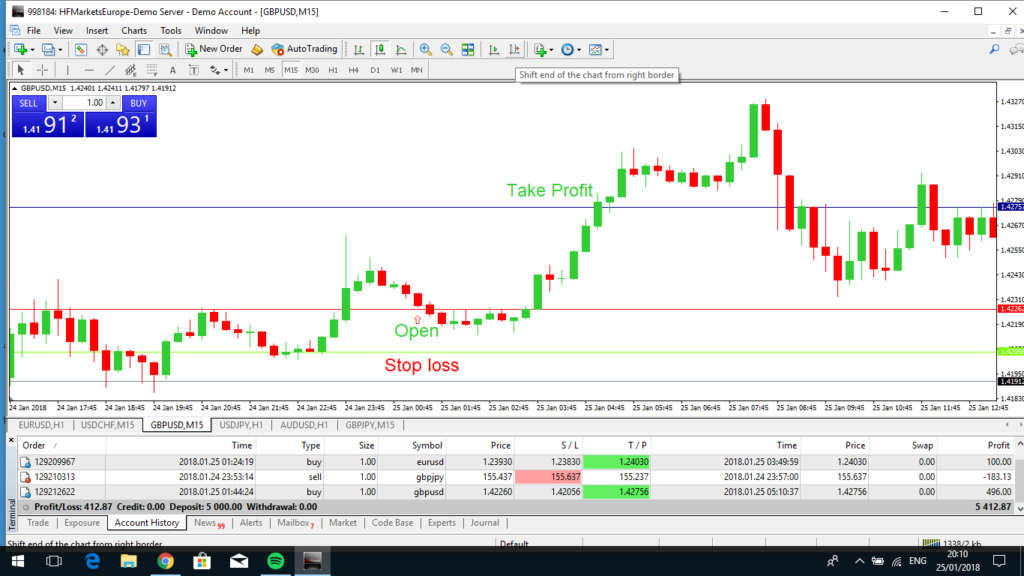

GBPUSD Trade

My previous success had been in the breakthrough of resistance and the probability that this would then act as support. Since they say markets repeat themselves, I found a nice example of a M15 break to a recent high and placed an order at the level of the close of the recent high bars.

Taking in to account the strong upward momentum of this pair I set a stop loss of 20pips below to allow the trade some room to breathe (and the support to kick in!), and a generous take profit level of 50pips which was just below an area of potential resistance. With my heart in my mouth I watched price fall through the line of support that I had identified and head towards my stop, before swinging around and easily driving up to my take profit level (see the chart below).

A dramatic first 3 trades and the account is positive! I’m up $412 or about 8.25%. Not bad for a days work.