April 16, 2018 – It has been a busy few weeks and finding time to look for potential trade setups has been difficult. I haven’t been very active since last month. Although I have seen a number of good opportunities, I am trying hard to be disciplined and highly-selective on those trades that I consider high probability.

Despite not being able to find many live trade setups with enough power to make me place an order I have, however, had time to do a lot of research. One of the things that sticks in my mind over the past weeks is the discussion by famed trader Dr. Alexander Elder who recommends that traders have an “arsenal” of trade setups, to account for different market conditions, rather than hunting for only a single trade (and then being forced to trade less reliable setups when these are not frequent enough). For newer traders I think this is very true and the temptation for me to take the first setup I recognise if I have not traded for some time is always there. I am, therefore, trying to diversify my strategies to form a small, interlinked arsenal of trading ideas and setups.

Finding Support and Resistance Levels

As I feel most naturally able to spot support and resistance zones after 3 months of hard study, I was hoping to incorporate these in to my next setup. Experienced traders say that you should go with what you feel most comfortable and “price action” is definitely a form of trading analysis that I most align to right now, even with my limited trading experience. One aspect of this is candlestick analysis and, in particular, the interaction of certain candlestick bars at the areas of support and resistance that I have identified.

Bullish and Bearish Engulfing Candlestick Patterns

Although candlestick analysis is both ancient and hugely popular already among traders, I am particularly interested in one candlestick pattern which seems to provide very high probability entry signals at areas of support and resistance. This is known as the “engulfing or outside bar” and is defined by the body of a candlestick engulfing the body of the previous candle. I am particularly interested in these candlesticks that form at key areas and show a powerful bounce off an area of support and resistance.

As far as I can see, these bullish and bearish engulfing candlestick patterns occur on all timeframes and seem to have good success rate in terms of defining the momentum of the following candles. As a short-term trade they appear to generate momentum and confirm the strength of the support and resistance zone. In terms of my own trading, they seem to fit very well with my initial idea to trade ‘bounces’, or touch trades, off the support and resistance zones. They also provide an additional confirmation of the strength of the zone, with a strong rejection allowing for a potential scalping opportunity on the shorter timeframes or a swing trade on the longer timeframes. I have decided to make this trade setup a priority for my next trade after I have backtested my ideas, and these candles, a little bit more thoroughly.

EURUSD Trade Setup

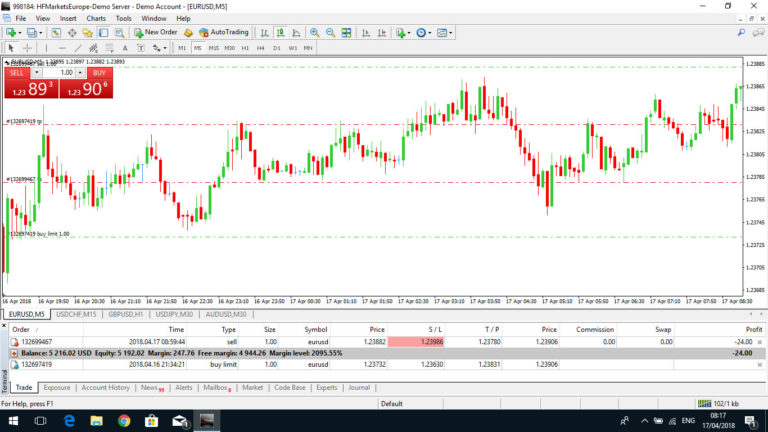

After looking through the markets this evening I came across one potential support and resistance trade on the EUDUSD that fulfilled my trading rules. The only problem was that this was outside market hours with limited liquidity and a period when markets tend to drift sideways. However, I have also noticed that the overnight markets still tend to react to the zones where there are a large number of pending orders. Things just tend to go a little bit slower; but if you are sleeping this is not too much of a problem. Given that markets move within a restricted range overnight, I placed a long order at the lower support level of 1.2373 (an area coinciding with the tip of the wick of a recent spike) and a short pending order at the recent high 1.2388 which had previously provided strong resistance.

As seen from the hourly chart below, the EURUSD was potentially on the way to forming a double top, unless it could break through the resistance of the recent high. This area was likely to be strongly contested with a large number of short orders in this zone which I hope would allow a 10 pip scalp, should price return near to this zone. One the other hand, there will also likely be bullish orders, hoping to break the resistance and push the EUDUSD beyond this level and in to higher territory. I was hoping that I had selected the areas where I had seen previous price action and both support and resistance in order to catch some momentum and result in a positive trade.

I was feeling fairly confident that one of these zones would be triggered overnight as Asian traders tested the resolve of the Euro bulls and bears. Overnight price moved within 1.5 pips of my entry price for both the long and short trades, which would have given two profitable trades if they had been opened.

Trade Execution

The trade was eventually triggered at around 0800 European time and price moved sharply higher to high the stop loss of the short trade. This is frustrating given how close the overnight range came to these areas but, for the time being, I have left the other long trade in the market, should price reverse to support the hourly double-top.

My account balance after this trade is 5.112,02 USD