- No Frills CFD Provider with Low Transaction Costs and Very Tight Spreads

- A Great Choice for Experienced Traders Looking to Keep Transaction Costs Low

- One of the Broadest Range of Instruments Including CFDs on Bitcoin, ETFs, and Index Options

- Strong Mobile Platform Including iOS, Android, and Windows Apps

- CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80.5% of retail investor accounts lose money when trading CFD's with this provider. You should consider whether you can afford to take the high risk of losing your money.

Current Promotions

Overview

Plus500 was founded in 2008 and quickly become one of the top CFD providers. Plus500 Ltd is listed on the Main Market of the London Stock Exchange and has offices in London, Israel, and Australia. What sets Plus500 apart from most of their competition is its tight spreads, keeping transaction costs low for active traders. Plus500 is also known for aggressively expanding its product palette to allow its clients to access all areas of the capital markets.

There is however some trade-offs to selecting this low-cost provider. Plus500 does not offer phone support, the Metatrader platform, or much in the way of market data and analysis and educational resources. It might not be the best choice for a novice trader requiring advice and support or a professional trader requiring advanced functionality such as automated trading or Metatrader. However, Plus500 is well suited for an experienced trader comfortable with a no-frills platform who is looking to minimize expenses. As always, note that your capital is at risk.

Trading Features

9.5Plus500 provides one of the broadest product palettes amongst its peers. In addition to the mainstays of FX majors, commodities, and indices, Plus500 also allows you to trade CFDs on many FX exotics, 10 different CFDs on digital currencies, 81 ETFs, and over 1900 individual shares from over 20 countries. It is one of the only CFD platforms to also offer index options.

One advantage of being able to access all areas of the capital markets on one platform allows you to more easily assess the performance of your overall trading portfolio. This may also reduce the frequency of margin calls as you may be able to offset, for instance, forex profits against equity losses. Plus500 also offers up to 30:1 leverage.

Market Analysis & Education

As a low-cost provider, Plus500 does not offer much in the way of forecasts, news, real-time market analysis, trading signals, etc… This will not hinder the experienced trader who can find this information free of charge from a variety of sources. Plus500’s software comes with a number of charting tools to allow you to perform technical analysis on your own. Plus500’s educational resources are also fairly limited with only a few basic articles on forex trading.

Trading Costs

10Plus500 does not charge any commission and offers some of the tightest spreads in the industry. Plus500 doesn’t charge any deposit fees, but it will levy a $10 inactivity fee after 3 months.

Account Options

8.5Customers can open accounts with only USD/EUR 100 or AUD 200. You can easily fund the account from your credit card, bank account, or a number of online payment services like PayPal and Skrill. Plus500’s minimum trade size can vary depending on the type of instrument you are trading with. Each instrument has a defined "Unit Amount", which is the minimum size of the trade or number of contracts/shares. To get a better idea of the product offerings and trading experience, you can also open a demo account free of charge.

Software Platforms

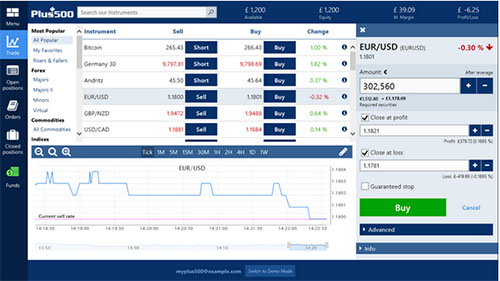

7.5Plus500 only allows customers to trade with its own proprietary trading platforms. It does not give you the option of using MetaTrader 4 like most brokers. Plus500’s software is very straightforward and is designed to be user friendly. One of the best features is the ability to set price alerts that sync across all of Plus500’s platforms and devices.

Desktop Trading

The customer has two options when trading on their PC. You can either download a PC application or use the web browser-based version. The downloadable version is compatible with Windows 10. The web trader is compatible with Chrome, Firefox, and Internet Explorer.

Mobile Trading

Customer Service

7Plus500 does not offer phone support but you can contact them via live chat or email. While this may seem a bit inconvenient Plus500 is known for having very fast response times to customer emails.

Safety and Security

8Playtech was set to acquire Plus500 in June 2015 at a price of GBP 460 million. Playtech is a London Stock Exchange-listed FTSE 250 gaming software and services provider and the owner of Markets.com. They originally intended to integrate these brokers at some point in the future. However, Playtech decided to walk away from the acquisition in November 2015 after it failed to gain regulatory approval for the merger from the FCA.

Plus500 is subject to high regulatory standards from some of the strictest regulators. Plus500 UK Ltd is authorized and regulated by the Financial Conduct Authority (FRN 509909). Plus500 CY LTD is authorized and regulated by the Cyprus Securities and Exchange Commission (License No. 250/14). Plus500AU Pty Ltd, AFSL #417727 issued by the Australian Securities and Investments Commission is authorized to issue these products to Australian residents. Plus500AU Pty Ltd is an authorized financial services provider in South Africa by the FSB (License No. 47546), and FMA in New Zealand, FSP #486026.

The FCA recently took regulatory action against Plus500 for not performing stricter checks in its anti-money laundering procedures. While this not endanger the safety of customer funds at any time, Plus500 was forced to freeze trading activity for some accounts until certain checks were completed. Plus500 was cleared to resume on-boarding new clients in January 2016. The FCA also fined Plus500 in 2012 for failing to report certain transactions and inadequate controls and systems.

80.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Customer Reviews

Submit your review | |