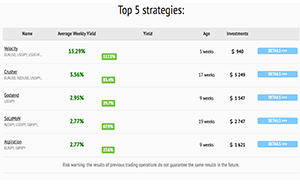

- Managed Forex Account Type(s): Strategy Manager via FXTM Invest, PAMM

- Platform(s): MT4 Multi Account Manager

- # of Active Managers: 400+

- Manager Accounts Available: Yes

- Investor Accounts Available: Yes

While all forex brokers allow you to make trades on your own account, only a select few enable you to employ professional managers to trade your account on your behalf.

Forex Managed Accounts

Here are some forex brokers who provide MAM, PAMM, and other types of managed forex trading accounts.

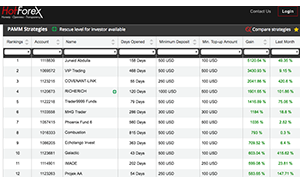

- Managed Forex Account Type(s): PAMM

- Platform(s): Hotforex PAMM App, MT4 MultiTerminal

- # of Active Managers: 300+

- Manager Accounts Available: Yes

- Investor Accounts Available: Yes

- Managed Forex Account Type(s): MAM

- Platform(s): MT4 Multi Account Manager

- # of Active Managers: Not Specified

- Manager Accounts Available: Yes

- Investor Accounts Available: Not Specified

- Managed Forex Account Type(s): RAMM (Risk Allocation Management Module)

- Platform(s): MT4 Multiterminal

- # of Active Managers: 30+

- Manager Accounts Available: Yes

- Investor Accounts Available: Yes

What are the Benefits of Managed Forex Accounts for Investors?

Benefits to investors include the ability to:

- participate in the forex markets without the time commitment of active trading

- harness the expertise for experienced professional currency traders

- diversify your risk by choosing more than one fx manager

One advantage of managed forex accounts over trading signal providers is that often the manager is required to invest alongside. The manager will have “skin in the game” where signal providers and other forex gurus may not have money committed to the strategy.

Managed account investors can often obtain advanced real-time and transparent reporting on trading portfolio performance from brokers. By contrast, pooled investment vehicles like ETFs and mutual funds often only provide quarterly reporting.

What are the Benefits of Managed Forex Accounts for Managers?

Benefits for managers include:

- the ability to monetize trading expertise via success fees paid by investors

- access to a large pool of trading funds

- attracting new funds when your broker shows your historical performance to potential investors

- your broker undertakes administrative burdens of calculating profits / losses, taking deposits, making withdrawals / distributions, and providing performance data.

What are some Factors to consider when choosing a Forex Account Manager?

- historical performance, volatility, max drawdown, average profit / loss, win / loss ratio

- account age

- trading strategy

- instruments traded, average trade size

- risk appetite

- use of leverage

- whether the manager is required to co-invest

- account equity and manager’s balance

- account currency

- minimum deposit, minimum top-up

- success fees

- early withdrawal fees

- high watermark provisions

- allocation type – lots, percentage, equity, etc…

- rollover period, trading period

The following is an exclusive interview with the founder of the Art of FX, Brian Jimerson. Brian is a highly successful, self-taught trader with over 7 years in the forex markets. He answers some questions on Multiple Account Manager (MAM) forex trading accounts and why you might want to consider including them in your investment portfolio. You can learn more about Brian at The Art of FX.

Q: In brief, what is a MAM account and how does it work?

MAM stands for Multi-Account Manager. Other brokers might also refer to this type of account as a PAMM (Percent Allocation Management Module). It’s a technical software setup that allows for multiple client accounts to be automatically consolidated into a single, centralized terminal for the account manager to trade from. In our case, we use a single installation of the trading terminal program MetaTrader 4 (MT4) to trade each strategy. The MAM is set up on the broker’s server, so allocation is instantaneous.

This solution fully automates the process of distributing profit/loss and trade volumes across all accounts, mostly removing the potential for human error with trading via multiple copies of MT4. When we enter a trade into our central MT4, it automatically executes the trade across all attached client accounts at the exact same time, opening trades at a size in proportion to the equity level of each account. So many of our trade entries and exits are incredibly time-critical, and each extra second saved can potentially be worth thousands of dollars.

Q: What some advantages to using a managed account instead of self-directed forex trading?

We are professional traders with years of experience, thousands of trades, and billions of dollars in volume under our belts. While self-directing trading can be successful, our clients rely on us to trade on their behalf, and we take on the responsibility of putting in up to 20 hours a day along with all stresses and skills involved to make their accounts as profitable as possible.

Q: What are some of the differences between MAM accounts and other automated trading services (e.g. expert advisors, social trade copying, etc…)?

Having your account managed by a professional trader is an entirely hands-off experience where the manager does all the work involved with trading the account. All of our trades are analyzed by our team and executed manually by our traders. While Expert Advisor robots and trade copying can be compared, the market is too complex and has far too many variables for a single algorithm or robot to operate consistently and effectively.

Q: What should I look for when choosing a manager?

You should always look for managers who are highly transparent, can offer a robust history, and are open to receiving and answering any question that you as a client may have.

Q: What percentage of my portfolio should I allocate to each manager? Should I use more than one MAM account?

It’s really up to you, depending on what your risk tolerance and diversification strategy is. We have clients who prefer to have their investment broken up across several different trading strategies and instruments, although most prefer to. Market conditions are always changing, and day-to-day, the money markets will be moving differently to the commodity markets, which will be moving differently to the equity markets.

Q: How are managers typically compensated for their services?

Most retail managers run on a profit-share and high waterline basis. That is, they take a percentage cut (often between 5-25%) of profits and don’t take a further fee unless they surpass that profit level in the future. This is to prevent a manager from taking a loss and then taking a cut of what essentially is a recovery of losses in the following months.

Also very common, especially among Hedge Funds are flat annual management fees, where managers charge a percentage of the overall invested equity balance.

Q: What are the typical minimum amounts to invest in a MAM account?

These can vary greatly depending on the management company, instruments, and operating country, but our minimum is US$30,000 for a minimum period for three years.

Q: Can I choose to withdraw my funds at any time from my MAM account?

After the minimum investment period ends, we provide our clients with regular withdrawal windows to take out all or part of their capital and profits.

At any particular time, we have multiple positions open in the market, so we ask our clients for two weeks’ notice of their intent to withdraw. This is so that we can safely settle positions and not jeopardize or sabotage existing and potential client profits.

Q: Can I see the performance of my MAM account in real-time? How should I evaluate the performance of my manager?

We’ve always had the philosophy that monitoring your account in real-time is an unhealthy way to follow your account. Investing in the markets is a long-term undertaking, and following the short-term ups and downs, especially for inexperienced investors is a great way to develop an ulcer. We do however provide our clients with a tracking link page, which is regularly updated and gives them both visual and statistical analysis of the standing of their investment.

How you evaluate your manager’s performance should be down whether their strategies and results are in line with your own personal investment goals and risk appetite.

Q: Do MAM accounts utilize leverage? Is this something I can customize based on my risk tolerance?

All accounts utilize leverage, however, it is up to your MAM provider to keep the risk under control, this is something that should always be discussed before your initial investment.

Q: I’d like to learn more about the MAM account service offered by your company, The Art of FX. What are some of the benefits of trading room access?

Something I really enjoy about the trading room is that people are always learning. For the most part, people that are interested in investing are always interested in learning to trade. So when I created the Art of FX I told myself I wanted to make it in a way that would allow clients to learn, stay involved, and always be able to ask questions to me directly. This creates an environment where people are allowed to simultaneously make money while also learning to trade. If one day they want to take control over their account and trade for themselves than for us, its mission accomplished.

Q: Please tell us about your trading strategy. How has your historical performance been like?

I feel like I get asked this question the most. All I can say about my strategy is that it is ever-evolving. There are a million ways to make money in the FX market, the idea is to find a couple of strategies you like and fine-tune them as much as possible until you are successful. I created a custom indicator over the years that helps me a lot with my setups, I am a firm believer it still works because I have never disclosed it with anyone else. For the performance part of this question, we prefer to aim for 5-10% monthly to our clients, this allows for very nice compounded gains. We often have months much higher but we have found it is better to focus on the smaller gains with more accuracy than bet the farm on every trade.

Q: What’s the best way to get in touch with you to learn more about your services?

One can always get a hold of me on my website Artoffx.com you can just sign up for free and come in and ask me direct questions. However right now it is under construction while we implement some new exciting features, my email is Brian@artoffx.com and I will always respond within a day or two, depending on how crazy the market is that day!

Thanks very much for your time.

Thank you as well, I enjoyed the interview.

FX Managed Accounts Summary

| Broker | Managed Forex Account Type | # of Managers | Manager Accounts | Investor Accounts |

|---|---|---|---|---|

| HotForex | PAMM | 300+ | ✓ | ✓ |

| FXTM | PAMM, Strategy Manager | 400+ | ✓ | ✓ |

| Avatrade | MAM | Not Specified | ✓ | Not Specified |

| RoboForex | RAMM | 30+ | ✓ | ✓ |