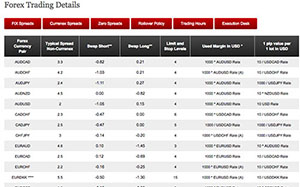

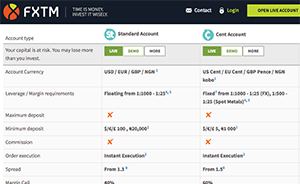

- 0.6 pips (ECN), EURUSD 1.5 pips (fixed)

- $2 Commissions only apply to ECN accounts who have the benefit of even narrower spreads

- $3 credit card withdrawal fee, e-wallet withdrawal fees of 0.5-3.9%, bankwire withdrawal fees depending on bank

- No miscellaneous fees

Fees and costs can stealthy chip away at your trading profits if not properly controlled, especially for high volume traders. An important first step in managing your transaction costs is selecting a low-cost broker.

In ranking these top low-cost forex brokers, we’ve select brokers based on their spreads, commissions, withdrawal fees, inactivity fees, other miscellaneous fees.

Top Inexpensive Forex Brokers

- Some of the lowest spreads: EURUSD 0.3 pips (currenex) 1.2 pips (floating), 1.8 pips (fixed)

- Commissions only apply to currenex and Zero Spread accounts who have the benefit of even narrower spreads

- No withdrawal fees

- No miscellaneous fees

- Note: HotForex no longer offers currenex accounts to new customers

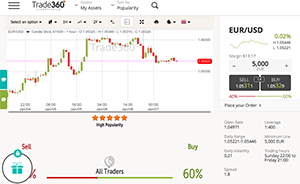

- EURUSD 1.8 pips (fixed)

- No Commissions

- No withdrawal fees

- If account balance is less than $50, a $50 inactivity fee after 3 months

- EURUSD spread - unspecified

- No Commissions

- No withdrawal fees

- $10 inactivity fee 3 months, overnight premiums

- CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80.5% of retail investor accounts lose money when trading CFD's with this provider. You should consider whether you can afford to take the high risk of losing your money.

Frequently Asked Questions

Q: What is a spread in Forex trading?

A: A spread is the difference between the bid price and the ask price of a currency pair in the Forex market. The bid price is the highest price that a buyer is willing to pay for a currency, while the ask price is the lowest price that a seller is willing to accept. The spread is the trader’s profit.

Q: How is the spread calculated in Forex trading?

A: The spread is typically expressed in pips, which is the smallest unit of price movement in the Forex market. For example, if the bid price for EUR/USD is 1.2050 and the ask price is 1.2053, the spread would be 3 pips.

Q: Why is the spread important in Forex trading?

A: The spread is important because it affects the cost of a trade. A larger spread means that it will be more expensive to enter and exit a trade, which can eat into your profits. Therefore, traders should aim to minimize the spread as much as possible.

Q: How can traders minimize the spread in Forex trading?

A: There are several ways that traders can minimize the spread:

- Use a Forex broker that offers competitive spreads

- Trade actively and make use of the broker’s volume-based discounts

- Trade during times of high liquidity, when the spread is typically narrower

- Use limit orders instead of market orders, which can help to reduce the spread

Q: Is the spread fixed or variable in Forex trading?

A: The spread can be either fixed or variable. A fixed spread means that the spread is always the same, regardless of market conditions. A variable spread means that the spread can change based on market conditions, such as liquidity and volatility.

Q: Are spreads in Forex trading the same for all currency pairs?

A: No, spreads can vary depending on the currency pair being traded. Some currency pairs, such as major pairs, tend to have smaller spreads because they are highly liquid and widely traded. Other currency pairs, such as exotic pairs, tend to have larger spreads because they are less liquid and less widely traded.

Q: Can spreads be negative in Forex trading?

A: It is possible for the spread to be negative, but this is relatively rare. A negative spread occurs when the bid price is higher than the ask price. This can happen in fast-moving markets where prices are changing rapidly. However, it is important to note that most Forex brokers do not allow traders to profit from negative spreads.

Q: How do spreads affect the profitability of Forex trades?

A: The spread can have a significant impact on the profitability of Forex trades. A larger spread means that it will be more expensive to enter and exit a trade, which can eat into your profits. On the other hand, a smaller spread means that it will be cheaper to enter and exit a trade, which can increase your profits. Therefore, it is important to choose a Forex broker that offers competitive spreads.

Summary

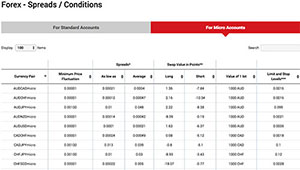

As a general rule, fixed spreads quoted by brokers will generally be slightly wider than floating spreads shown. For entry-level accounts, minimum spreads for fixed spread Forex brokers are around 1.5 pips compared to 0.5 pips floating spread brokers. Note, however, floating spreads may increase and exceed fixed spreads in times of market illiquidity.

Fees and charges may also vary by account type so it’s important to read the fine print. The information listed here generally pertains to a broker’s entry-level account unless otherwise specified.

Some brokers will offer no spread ECN or Currenex accounts. However, commissions are charged on these types of accounts and are best suited for large high volume traders.

Cheap Forex Brokers Ranking Table

Here is a table summarizing the top 5 low-cost forex brokers.

| Broker | EURUSD Fixed Spread | EURUSD Floating Spread | No Withdrawal fees | No Inactivity Fees | No Misc Fees |

|---|---|---|---|---|---|

| HotForex | 1.8 pips | 0.3 pips (Currenex), 1.2 pips (Zero) | ✓ | ✓ | ✓ |

| ForexTime | 1.5 pips | 0.6 pips (ECN) | ✗ | ✓ | ✓ |

| Trade360 | 1.8 pips | - | ✓ | ✗ | ✓ |

| Plus500 | - | - | ✓ | ✗ | ✗ |

| XM | - | 1.8 pips | ✓ | ✓ | ✓ |