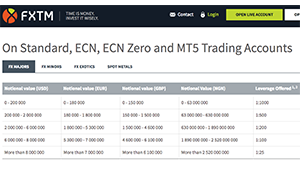

- 1000:1 leverage on FX Majors and 500:1 leverage on FX Minors for Standard, ECN and MT5 accounts

- 200:1 leverage on FX Majors and Minors for FXTM Pro Trading Accounts

- Max leverage may decrease as the notional value of trades increase above certain thresholds

Leverage is a key weapon in the highly competitive world of forex trading that can work for or against you. Most forex brokers outside of the US offer up to 200:1 leverage, however, there are a number brokers who are willing to go beyond this.

In ranking the forex brokers with the highest leverage, we examine maximum leverage, whether brokers apply leverage uniformly or vary leverage by pair, vary by account type or allow you to set leverage based on your individual risk tolerance.

Forex Brokers Offering High Max Leverage

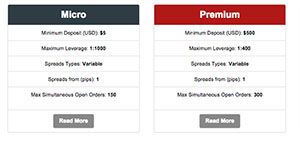

- up to 1000:1 leverage for micro accounts

- up to 400:1 leverage for premium, currenex, fixed spread, and auto accounts

- up to 300:1 leverage for VIP and PAMM accounts

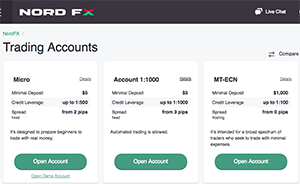

- up to 1000:1 leverage for Account 1000:1

- up to 500:1 leverage for Micro Accounts

- up to 200:1 leverage for Standard and Standard MT5 Accounts

- 40% margin call level, 20% stop out levels for Account 1000:1, Micro, Standard and Standard MT5 Accounts. However, these may be increased prior to market close.

- Up to 1000:1 leverage

- You can change your leverage to 1000:1, 888:1 or 700:1 at any time

- Max leverage will be limited to 500:1 if your account equity exceeds USD 2000

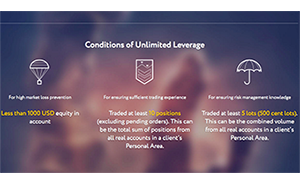

- Choose your leverage from 2:1 to "Unlimited" for cent, mini and classic accounts

- Maximum leverage will vary by forex pair and account equity and will be decreased to 200:1 upon market close

- Traders are only eligible for "Unlimited Leverage" if account equity is less than $1000, they have made at least 10 trades totaling more than 5 lots

- up to 200:1 leverage for ECN accounts

- Up to 888:1 leverage

- This leverage does not apply to all entities of XM Group

- You can set your own leverage between 1:1 to 888:1

- Leverage depends on the financial instrument traded and the client's country of residence

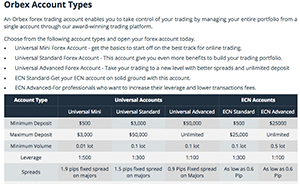

- Up to 500:1 leverage for Mini accounts. Max leverage decreased to 300:1 if account equity exceeds $3,000.

- Up to 300:1 leverage for Standard accounts. Max leverage decreased to 100:1 if account equity exceeds $50,000.

- Up to 100:1 leverage for Advanced accounts.

- Up to 400:1 leverage for floating spread accounts

- Up to 200:1 leverage for fixed spreads accounts

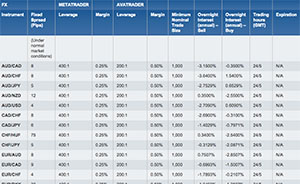

- Up to 400:1 on FX Majors, up to 50:1 on FX Minors

- Up to 50:1 on Commodities

- Up to 200:1 on ETFs

- Up to 50:1 on Stock Indicies, Up to 20:1 on Individual Stocks

- 4:1 on Bitcoin

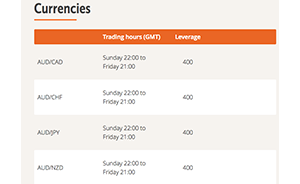

- up to 400:1 leverage

- Same leverage maximums for all accounts

- You can set leverage as low as 2:1 and as high as 400:1 for forex and the default setting will be 50:1

How Does Leverage Work in Forex Trading?

As we see above, forex brokers tend to offer the highest leverage ratios to the smallest accounts. While this might seem counterintuitive, there are several reasons for doing this. Firstly, although the leverage ratio may be higher, the absolute dollar amount at risk is lower for micro accounts given smaller trade sizes and account equity. Secondly, higher leverage can also reduce the frequency of margins calls allowing new traders to withstand more market volatility without having to commit more capital.

Certain brokers like Roboforex, Exness, and eToro will allow you to set your own level of leverage within given parameters. This is a nice feature for more risk-averse traders.

In addition to the maximum leverage ratios, be sure to allow at the top up and sell out levels applicable to your forex accounts. This should be described in the terms and conditions of your brokerage agreement. It will determine when your broker makes a margin call and when they may liquidate your positions if your trades go against you. Also, keep in mind that certain brokers like NordFX and Exness may reduce the amount of leverage they provide upon market close.

Brokers will generally offer higher leverage to more liquid and less volatile instruments (e.g. FX majors, Indicies) and offer lower leverage on more thinly traded instruments (e.g. Bitcoin, Individual Equities). Higher leverage on more stable pairs allows traders to generate attractive returns on small price changes.

Unlimited Leverage Brokers – Understanding Risk

Unlimited leverage refers to brokers that offer extremely high leverage ratios, sometimes even exceeding 1:1000 or more. While this may seem appealing as it allows traders to control larger positions with a minimal initial investment, it also comes with significant risks that need to be fully understood.

Risks Associated with Unlimited Leverage:

1. High Potential for Loss: Trading with unlimited leverage can lead to rapid and substantial losses. Even small price movements can result in significant account drawdowns, potentially wiping out the entire account balance.

2. Limited Margin for Error: With high leverage, traders have little room for error. A slight adverse market movement can trigger a margin call, forcing traders to either deposit more funds or close losing positions.

3. Psychological Pressure: High leverage can lead to impulsive and emotionally driven trading decisions. The stress of managing large positions with limited capital can negatively impact a trader’s decision-making process.

4. Overtrading: The allure of potential profits with unlimited leverage can encourage traders to overtrade, taking excessive positions and increasing the risk of significant losses.

5. Unpredictable Market Volatility: Forex markets can experience sudden and extreme price fluctuations, especially during news releases or market events. High leverage increases the vulnerability of traders to such volatility.

Tips for Responsible Trading:

1. Educate Yourself: Before trading with any broker, especially those offering unlimited leverage, thoroughly educate yourself about forex trading, risk management strategies, and market analysis techniques.

2. Choose a Regulated Broker: Opt for brokers regulated by reputable financial authorities. Regulatory oversight ensures a certain level of transparency and accountability.

3. Start Small: If you’re a beginner, consider starting with a modest leverage ratio or even a demo account to practice trading without risking real funds.

4. Use Leverage Wisely: If you decide to use leverage, always do so cautiously and within your risk tolerance. Avoid using maximum available leverage, and consider lower ratios to reduce risk.

5. Set Stop-Loss Orders: Implement stop-loss orders for each trade to limit potential losses. A stop-loss order is a predefined level at which a trade will automatically close if the market moves against you.

6. Diversify Your Portfolio: Don’t put all your capital into a single trade. Diversification can help spread risk across multiple trades and instruments.

7. Practice Risk Management: Never risk more than a small percentage of your trading capital on a single trade. A common rule of thumb is to risk no more than 1-2% of your total capital on any given trade.

8. Keep Emotions in Check: Emotions can cloud judgment, leading to impulsive decisions. Stick to your trading plan and strategy, even in the face of market fluctuations.

9. Monitor News and Events: Stay informed about economic indicators, news releases, and geopolitical events that could impact the forex market. Be cautious when trading during high-volatility periods.

10. Continuous Learning: Forex markets are dynamic and ever-changing. Stay committed to continuous learning and improvement to adapt to market conditions.

Remember that trading with high leverage requires a high level of skill, discipline, and risk management. It’s crucial to understand the risks and make informed decisions to protect your capital and achieve sustainable trading success. If you’re a beginner, consider seeking guidance from experienced traders or financial advisors before diving into live trading with unlimited leverage brokers.

FX Broker Leverage Ranking Summary

| Broker | Max Leverage | Bonus |

|---|---|---|

| HotForex | up to 1000:1 | 100% deposit bonus, 30% rescue bonus, 100% credit bonus |

| ForexTime | up to 1000:1 | up to $5 per lot cashback bonus, $25 referral bonus |

| NordFX | up to 1000:1 | up to 100% deposit bonus, demo trading contest prize up to $1000, referral bonus of 10% of friend's deposit amount |

| Robo Forex | up to 1000:1 | $30 welcome bonus, 50% first deposit bonus up to $6,000, 115% classic deposit bonus up to $20,000 |

| Exness | up to unlimited* | - |

| XM | up to 888:1 | $30 no deposit bonus, 20% deposit bonus |

| Orbex | up to 500:1 | $100 referral bonus |

| AvaTrade | up to 400:1 | $400 referral bonus |

| Trade360 | up to 400:1 | $50 no deposit bonus, 40% deposit bonus, cashback rewards |

| Etoro | up to 400:1 | $100 referral bonus |